Renters Insurance in and around West Palm Beach

Get renters insurance in West Palm Beach

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- West Palm Beach

- Palm Beach Gardens

- Lake Worth

- Palm Beach

- North Palm Beach

- Royal Palm Beach

- Wellington

- Jupiter

- Delray Beach

- Lantana

- Miami

- Fort Lauderdale

- Juno Beach

- Hobe Sound

- Boca Raton

- Coral Gables

- Naples

- Tampa

- Sarasota

- Jacksonville

- Orlando

- Tallahassee

- St Augustine

- Vero Beach

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - utilities, size, outdoor living space, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in West Palm Beach

Renting a home? Insure what you own.

Renters Insurance You Can Count On

When the unexpected theft happens to your rented condo or home, usually it affects your personal belongings, such as a bicycle, a tablet or a set of golf clubs. That's where your renters insurance comes in. State Farm agent Vivian Suarez can help you examine your needs so that you can protect yourself from the unexpected.

Renters of West Palm Beach, State Farm is here for all your insurance needs. Call or email agent Vivian Suarez's office to get started on choosing the right policy for your rented property.

Have More Questions About Renters Insurance?

Call Vivian at (561) 619-4640 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

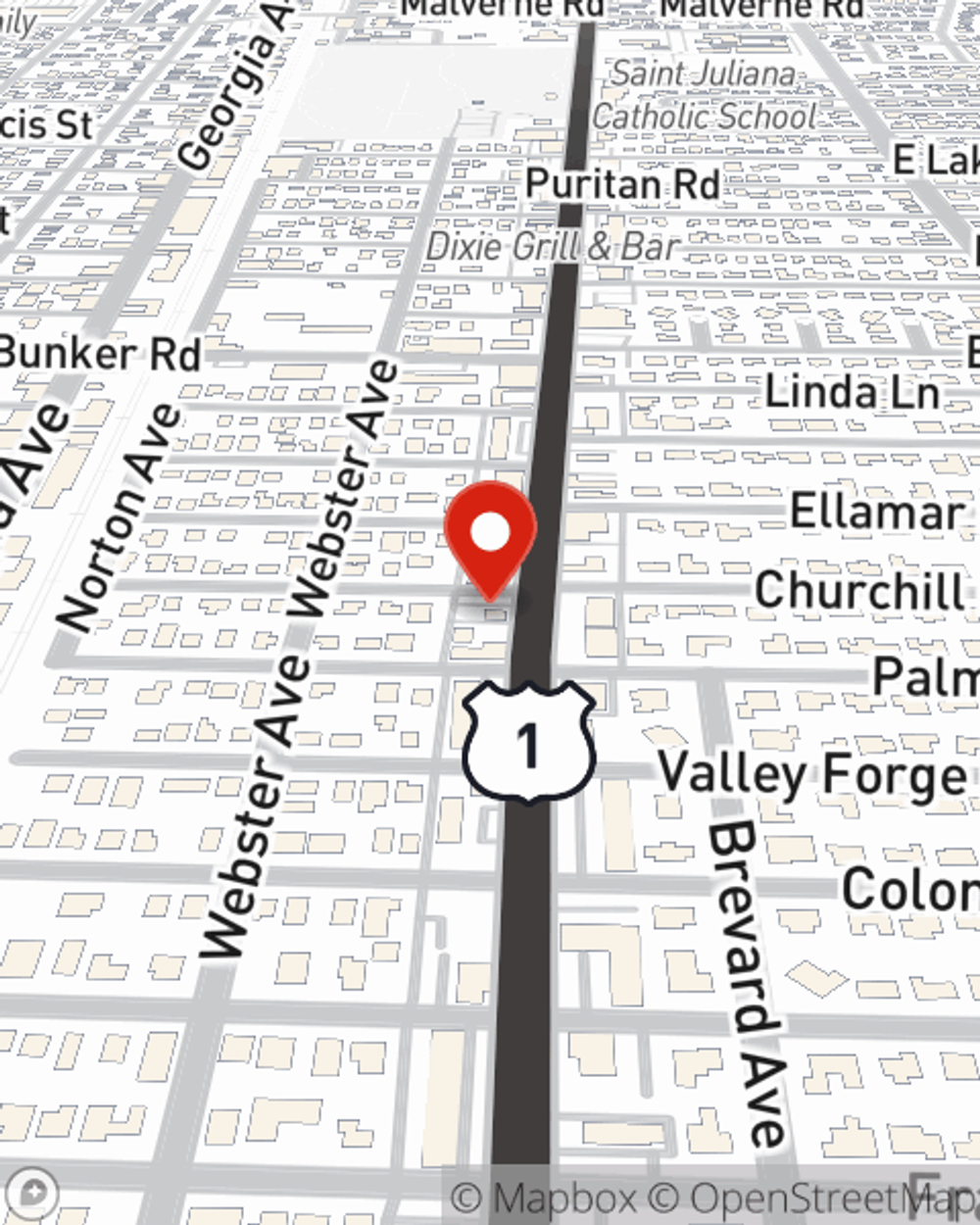

Vivian Suarez

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.